The moments after a property fire are chaotic and deeply stressful. As a homeowner or property manager in Orange County, what you do in the first 24 hours is absolutely critical—it lays the groundwork for your entire fire damage insurance claim and can significantly impact your final settlement.

Navigating this process requires a clear, strategic approach focused on three priorities: ensuring everyone’s safety, properly notifying your insurance company, and bringing in a professional restoration team to prevent further damage.

Your First 24 Hours After a Property Fire

Dealing with the aftermath of a fire is incredibly challenging, especially while you are in shock. For property owners here in Southern California, having a clear action plan cuts through the chaos, turning a devastating event into a manageable recovery process. This protects not only your family or tenants but also your financial future.

Your first responsibility is always safety. Once the fire department gives the all-clear, confirm that every family member, employee, or tenant is accounted for. It is crucial that you do not re-enter the property until a professional has confirmed it is structurally safe.

Notifying Your Insurer The Right Way

After ensuring everyone’s safety, your next call should be to your insurance provider to report the loss.

When you speak with them, stick to the facts. Provide your name, policy number, property address, and the date the fire occurred. This is not the time to speculate on the cause of the fire or the extent of the damage. Simply state what you know for sure. This direct, factual conversation initiates the fire damage insurance claims process and establishes you as an organized and credible policyholder from the very beginning.

“Your first communication with the insurance company is not the time for emotion or guesswork. Stick to the known facts. Your goal is to open the claim efficiently and establish yourself as a credible, organized policyholder from day one.”

The Critical Need for Professional Mitigation

As soon as you hang up with your insurer, your very next call should be to an IICRC Master Certified restoration company like Sparkle Restoration Services. Do not delay this step. Fire damage is an ongoing process; soot, smoke, and the water used to extinguish the flames continue to cause secondary damage long after the fire is out.

Here in Orange County, our climate can accelerate mold growth at an alarming rate. Those first hours are your window to prevent a bad situation from becoming much worse. This principle of rapid response is just as vital in other disasters, as detailed in a guide to navigating storm damage roof repair and insurance.

A professional restoration crew from an award-winning firm like Sparkle will take immediate action. They’ll:

- Secure the Property: Board up compromised windows, doors, and other openings to prevent unauthorized entry and protect the interior from the elements.

- Assess the Damage: Provide an immediate, expert evaluation of the structural, smoke, and water damage.

- Begin Mitigation: Start water extraction and set up professional-grade drying equipment to halt mold growth and prevent further structural decay.

- Address Lingering Odors: Smoke permeates everything. Specialized equipment and techniques are required for complete odor removal to restore your property’s indoor air quality and comfort.

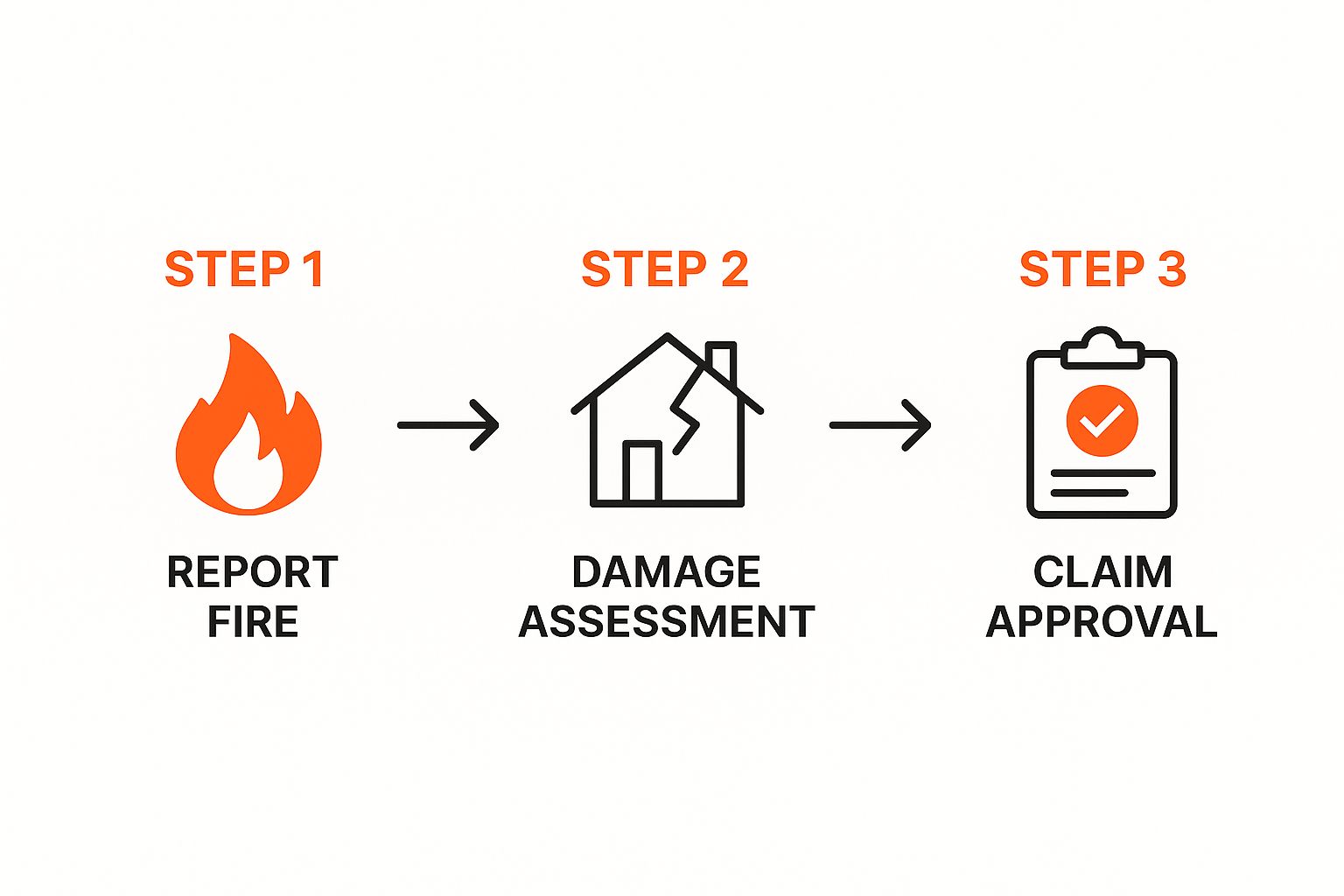

This chart illustrates how a structured approach, starting with that immediate call, provides the clearest path to a successful claim.

To help you stay focused during this overwhelming time, here is a quick-reference checklist of what you absolutely must do.

Immediate Action Checklist After a Fire

| Priority Action | Why It’s Critical | Who to Contact |

|---|---|---|

| Confirm Everyone’s Safety | Your top priority is the well-being of family, pets, or employees. Possessions are secondary. | Family members, emergency services (if needed) |

| Contact Your Insurance Company | This officially starts the claims process and gets an adjuster assigned to your case quickly. | Your insurance agent or the company’s 24/7 claims hotline |

| Secure Professional Restoration Help | Prevents secondary damage from water, smoke, and soot, which insurance may not cover if you delay. | An IICRC Master Certified firm (e.g., Sparkle Restoration) |

| Do Not Re-enter the Property | It’s unsafe due to structural risks, hidden hot spots, and toxic fumes. | Wait for clearance from the fire department or a structural engineer |

| Request a Copy of the Fire Report | This official document is essential for your insurance claim. | The local fire department |

Having this list provides a sense of control when you need it most. Following these steps ensures you are proactively managing your recovery from the very start.

Building a Bulletproof Claim Inventory

Once the initial shock subsides, the meticulous work of documenting your loss begins. One of the most demanding but essential steps in your fire damage insurance claims process is creating a detailed inventory of every single item lost or damaged. This list is more than a personal record; it is the core evidence you will use to justify the value of everything that needs to be repaired or replaced.

A vague or rushed inventory is the fastest path to a low settlement offer. A thorough, organized one is the foundation of a successful claim and is your key to receiving a fair payout.

Think of it as building a case for your insurance adjuster. The more detailed and compelling your evidence, the smoother the process will be. This is particularly true for homeowners in communities like Newport Beach or Irvine, where high-end finishes and valuable belongings mean every detail is significant.

Documenting Everything Room by Room

The most effective way to tackle this immense task is methodically. Proceed room by room. Before a single item is moved or discarded, use your smartphone to record everything.

Start with wide video sweeps of each room to establish the overall scene, then take numerous detailed photos. Open every drawer and closet to document the contents. Don’t just photograph a damaged television; get a close-up of the brand, model, and serial number if possible. These details provide irrefutable proof of an item’s quality and value.

Your inventory is your primary negotiating tool. Every forgotten item is money left on the table. Be exhaustive in your documentation—it’s far better to have too much detail than not enough.

As you document, build a corresponding spreadsheet. For each item, log the following information:

- Item Description: Be specific. Not “TV,” but “Samsung 65-inch QLED 4K Smart TV, Model QN65Q80A.”

- Original Purchase Date & Price: If receipts are unavailable, make your best estimate. Search old photos, credit card statements, or emails to verify.

- Item Age & Condition: Honestly assess the item’s pre-fire condition (e.g., “Excellent,” “Good,” “Used”).

- Estimated Replacement Cost: This is crucial. Research online to determine the cost to purchase the same or a comparable item brand new today.

This systematic process prevents omissions and presents your claim in a professional format that adjusters can easily process.

Understanding ACV vs. RCV

You will encounter two key acronyms: Actual Cash Value (ACV) and Replacement Cost Value (RCV). The difference between them can amount to thousands of dollars in your settlement.

Most standard policies initially pay the ACV. This is the value of your item today, accounting for depreciation due to age and wear.

RCV is the full cost to replace your item with a new one of similar kind and quality. To receive the remaining funds (the difference between ACV and RCV), you typically must purchase the replacement item and submit the receipt to your insurer. Understanding this upfront is essential for managing your budget during recovery.

What If I Don’t Have Receipts?

This is a common concern. Do not panic. Lacking a receipt for every item is normal and does not invalidate your claim. Your detailed photos and videos become your primary evidence. You can also prove ownership and value with:

- Credit Card or Bank Statements: Excellent for showing proof of purchase for major items.

- Original Packaging or Manuals: A box or manual can help establish the model and original price.

- Photos and Videos from Before the Fire: Holiday photos and family videos showing your belongings in your home serve as valuable evidence.

To build a truly bulletproof claim, your inventory must also cover the structure itself. Accurately understanding repair costs for major components like roofing is non-negotiable. This is where a professional restoration partner like Sparkle, a licensed General Contractor, provides immense value. We demonstrated this in complex projects like this Irvine restoration and kitchen remodel, where meticulous documentation was key to a successful insurance outcome.

The financial scope of these events is significant. In the first half of a recent year, global insured losses from natural catastrophes, including fire damage insurance claims, exceeded $80 billion. With California’s wildfires contributing heavily to these costs, a meticulously prepared claim is vital for our state’s homeowners.

Documentation You Can’t Afford to Forget

| Document Type | Purpose in Your Claim | Pro Tip for Collection |

|---|---|---|

| Photos & Videos | Provides undeniable visual proof of your possessions and the extent of the damage. This is your primary evidence. | Take more than you think you need. Capture wide shots of rooms, close-ups of damage, and any brand names or serial numbers you can find. |

| Detailed Inventory List | Creates a formal, itemized record of your losses that the adjuster can easily review and process for valuation. | Use a spreadsheet. List the item, brand, model, age, pre-fire condition, and the current cost to replace it. |

| Proof of Ownership | Substantiates that you actually owned the items you are claiming. This builds credibility and prevents disputes. | Dig up old receipts, credit card statements, user manuals, or even family photos that show the items in your home. |

| Contractor Estimates | Establishes the real-world cost to repair structural damage, providing a basis for your dwelling coverage settlement. | Get at least two or three detailed, written bids from reputable, licensed contractors. Don’t rely solely on the insurer’s vendor. |

| ALE Receipts | Documents your Additional Living Expenses (like hotel stays, meals, laundry) so you can be reimbursed by your insurer. | Keep a dedicated folder or envelope for every single receipt. No expense is too small to track. |

Communicating with Your Insurance Adjuster

Once your fire damage insurance claim is filed, your insurance company will assign an adjuster to your case. This individual is your primary point of contact and holds significant influence over your settlement. It is crucial to understand their role: while they may be empathetic, their primary duty is to protect the insurance company’s financial interests.

Your approach to interacting with the adjuster will set the tone for the entire claims process. The goal is to cultivate a professional, collaborative relationship. You are not seeking a confrontation; you are seeking a fair settlement based on the facts of your policy, and the best path to achieving this is through preparation, organization, and confidence.

Preparing for the Adjuster’s Inspection

The adjuster’s initial site inspection is a pivotal moment. They are there to create their own damage assessment, which will form the basis of their first settlement offer. Your role is to guide them, ensuring nothing is overlooked.

Before they arrive, have your detailed home inventory, photos, videos, and any contractor estimates ready. Accompany them on the walk-through. Point out damage that may not be immediately obvious, such as smoke penetration in attic insulation or soot that has settled inside cabinets and behind walls. Do not speculate on the cause of the fire or downplay the damage by saying things like, “it’s not that bad.” Stick to the facts you have documented.

Mastering Your Communication Strategy

Every conversation—whether by phone, email, or text—becomes part of your official claim record. It is essential to be methodical and professional in all communications.

A few expert tips:

- Create a Paper Trail: After any phone call or meeting, send a brief email summarizing the key points discussed. This creates a written record and prevents misunderstandings.

- Be Responsive and Organized: When the adjuster requests information, provide it promptly. Presenting a well-organized folder with your inventory and contractor bids demonstrates your seriousness.

- Answer Questions Carefully: Be honest but concise. Answer only the specific question asked without volunteering extraneous information or opinions that could be used to limit your claim.

By managing the flow of information and documenting every step, you position yourself as an informed and proactive homeowner.

“Your communication with the adjuster should be guided by a simple principle: ‘Trust, but verify in writing.’ A documented conversation prevents ‘he said, she said’ disputes and holds everyone accountable.”

Handling a Low Settlement Offer

It is common for the first settlement offer to be lower than expected. Do not panic. This is often an opening position in a negotiation. The adjuster may have overlooked hidden damage or used outdated pricing for labor and materials in Orange County.

Your first step is to request a detailed, line-by-line breakdown of their offer. Compare it against the comprehensive estimate from a trusted, IICRC-certified restoration company like Sparkle Restoration. Our estimates are built using the same industry-standard software that insurance carriers use, making it difficult for them to dispute legitimate costs.

If discrepancies exist, draft a formal written response. Calmly and factually, identify each item they undervalued or omitted, and provide your contractor’s estimate as supporting evidence. To better understand the entire claims journey, our guide on navigating property insurance claims for homeowners is an excellent resource.

This professional, evidence-based approach is far more effective than an emotional reaction. It demonstrates that you have done your research and expect a fair settlement to restore your property completely.

Common Mistakes That Jeopardize Fire Claims

When you’re dealing with the aftermath of a fire, navigating the insurance claim process can feel like walking through a minefield. Homeowners here in Orange County, even with the best of intentions, often make small missteps that wind up having huge financial consequences. These little mistakes can lead to frustrating delays, outright denials, or settlements that fall way short of what’s needed.

Knowing what these common pitfalls are is the first and most important step toward protecting your right to a full and fair recovery.

One of the most frequent errors we see is discarding damaged items too soon. In the rush to clean up, it’s tempting to haul charred furniture and smoke-damaged belongings to the curb. Resist this urge. Those items are your most critical evidence. Your insurance adjuster needs to see the extent of the damage firsthand to accurately assess your loss.

When you dispose of items before they have been professionally documented and inspected, you are essentially destroying evidence. This gives the insurance company a valid reason to question the value—or even the existence—of the items you’re claiming, which seriously weakens your negotiating position.

Underestimating Hidden Damage

Another major oversight is failing to grasp just how far the damage spreads, especially from smoke and soot. The flames are what you see, but the invisible damage is often just as destructive and expensive to fix. Smoke particles are microscopic and incredibly invasive; they get into everything from wall cavities and HVAC systems to your clothes and furniture.

Soot isn’t just a mess, either—it’s acidic and corrosive. If left unaddressed, it can permanently etch glass, tarnish metal fixtures, and cause electronics to fail weeks or months later. Many homeowners focus only on the obvious burn damage, leaving thousands of dollars in hidden restoration costs unclaimed. This is why a professional assessment is non-negotiable.

A huge misconception is that if an area doesn’t look burned, it’s fine. The reality is that corrosive smoke and soot cause long-term, systemic damage to your home’s structure and systems. A professional, deep cleaning and inspection are essential for a complete recovery.

Signing Away Your Rights Prematurely

In the chaos following a fire, you will likely be presented with multiple documents to sign. Be extremely cautious. Signing a broad release form from your insurance company without thorough review could prematurely close your claim. This means if you discover additional damage later, you may have no recourse.

Similarly, some homeowners accept the first settlement offer just to conclude the ordeal. Initial offers are almost always based on a preliminary assessment and rarely cover the full cost of a proper restoration. Always obtain a second opinion from a trusted, certified restoration expert before agreeing to any settlement. A detailed, line-item estimate from an expert like Sparkle Restoration becomes your most powerful negotiation tool.

- Mistake 1: Discarding Damaged Items. Never dispose of anything until it has been inspected and documented by both you and your adjuster. Your damaged belongings are the primary proof for your claim.

- Mistake 2: Ignoring Smoke and Soot. Insist on a thorough inspection of your entire property, including ductwork, attics, and wall cavities, to identify hidden damage from corrosive soot and pervasive smoke.

- Mistake 3: Premature Sign-Offs. Do not sign any final settlement agreements or general release forms until you are 100% certain the offer covers all restoration costs outlined by your trusted contractor.

Attempting to handle complex cleaning or repairs yourself can also backfire. Using the wrong cleaning products can permanently set smoke stains, and improper techniques can worsen the damage. This is not the time for a DIY approach; a single misstep could cause more damage and may even give your insurer a reason to deny that portion of your claim. Discovering the dark side of DIY projects during an insurance claim is a hard lesson to avoid. By sidestepping these common errors, you protect your investment and ensure your claim is handled correctly from the start.

The Role of a Certified Restoration Partner

Successfully filing your fire damage insurance claim is a huge milestone, but it’s really just the halfway point. The true goal is to restore your home or business to its pre-fire condition—or even better. This is where the quality and expertise of your restoration partner become the most critical factor in your recovery.

Choosing the right partner is more than hiring a contractor. It’s about engaging an expert advocate who can navigate the complexities of both restoration and the insurance process on your behalf. For property owners in Orange County, this choice can mean the difference between a stressful, incomplete job and a seamless, high-quality restoration that maximizes your insurance settlement.

The Power of an IICRC Master Certified Firm

Not all restoration companies are created equal. An IICRC Master Certified firm like Sparkle Restoration Services, a winner of the BBB Torch Award for Ethics, operates at a level of expertise that insurance companies recognize and respect. This certification isn’t just a logo; it represents a deep, scientific understanding of fire, smoke, and water damage.

When our certified technicians assess your property, we see far more than charred walls. We are trained to identify hidden issues an adjuster might miss:

- Structural Integrity: We evaluate how intense heat can compromise framing, trusses, and foundational elements.

- HVAC Contamination: Smoke and soot travel through ventilation systems, requiring specialized cleaning to ensure healthy air quality and prevent future issues.

- Corrosive Soot Residue: We understand soot’s acidic nature. If not professionally removed, it will continue to degrade electronics, plumbing fixtures, and metal surfaces.

This detailed, science-backed assessment forms the basis of a comprehensive scope of work that leaves no stone unturned.

Speaking the Adjuster’s Language

A significant advantage of partnering with an experienced firm is our fluency in the language of insurance. We utilize Xactimate, the same industry-standard software that 90% of insurance carriers use to estimate repair costs. This immediately levels the playing field.

When we submit our estimate, it’s not just a contractor’s bid; it’s a detailed, line-item report that speaks directly to your adjuster in a format they know and trust. We justify every cost with precise measurements, current local material prices, and standardized labor rates.

By presenting a meticulously documented scope of work in the industry’s native software, we eliminate much of the back-and-forth negotiation. It shifts the conversation from arguing over price to agreeing on the necessary steps for a proper restoration.

This approach elevates us from a vendor to a powerful advocate for your claim. We work directly with your adjuster, providing the technical evidence needed to ensure everything—from structural repairs to professional deodorization—is included in your settlement. It’s a core component of our comprehensive fire damage restoration services.

Your Advocate from Chaos to Calm

Ultimately, the role of a certified restoration partner is to manage the entire overwhelming process, allowing you to focus on your family or business. As a licensed General Contractor and IICRC Master Certified firm, Sparkle Restoration handles it all, ensuring a seamless transition from initial damage mitigation to the final remodeling touches.

We coordinate with engineers, architects, and specialized tradespeople, making sure every repair meets or exceeds local building codes and your own high standards. This integrated, design-build approach not only simplifies the process for you but also guarantees a higher quality outcome.

By managing the technical details and advocating for a complete and fair settlement, we fulfill our brand promise of “Turning Chaos Into Calm, Fast.” We handle the complexities so you can move forward with confidence, knowing your property is in the hands of proven experts dedicated to restoring its value, safety, and comfort.

Common Questions About Fire Damage Claims

When you’re dealing with the aftermath of a fire, trying to understand your insurance policy can feel like learning a new language under the worst possible circumstances. We see homeowners all over Orange County wrestling with the same tough questions. Based on our decades of experience restoring homes and managing claims, we’ve put together some straightforward answers to the questions we hear most often.

Our goal here is to cut through the confusion and give you the knowledge you need to protect your family and get the fair settlement you’re entitled to.

How Long Do I Have to File a Fire Damage Claim in California?

This is a critical point of confusion. While California law may provide a statute of limitations of a couple of years for filing a lawsuit over property damage, your insurance policy operates on a much faster timeline. Nearly every policy contains a clause requiring “prompt” or “immediate” notification of the loss.

In practice, this means you should notify your insurance company within 24 to 72 hours of the fire. Delaying this call could give the insurer grounds to argue that you failed to meet your contractual obligations, potentially jeopardizing your entire claim. The best practice is to check your policy for specific language, but do not wait—make the call as soon as it is safe to do so.

What Is Loss of Use Coverage and How Does It Work?

Loss of Use, also known as Additional Living Expenses (ALE), is one of the most vital components of your homeowners’ policy after a fire renders your home uninhabitable. This coverage is designed to pay for the extra costs you incur while displaced.

It is not a blank check. ALE covers expenses that are above and beyond your normal monthly spending. Common covered costs include:

- Hotel stays or a temporary rental property.

- Increased food costs from dining out if you cannot cook.

- Laundromat expenses if your laundry appliances are unusable.

- Furniture rental for your temporary residence.

You absolutely must keep every single receipt for these expenses. Your insurance company will demand detailed proof before they reimburse you. The key to even starting your ALE benefits is proving your home is uninhabitable, and a certified restoration expert like Sparkle provides the official report needed to do just that.

Should I Hire a Public Adjuster?

For a very large, complex, or contentious claim, a public adjuster can be a valuable ally. They work exclusively for you, not the insurance company, and typically charge a percentage of your final settlement as their fee.

However, for many fire damage claims, partnering with a top-tier, IICRC Master Certified restoration company can achieve the same or better results—without you giving up a portion of your settlement. At Sparkle Restoration, we build our estimates with the same Xactimate software as insurance carriers. We act as your advocate, negotiating directly with your adjuster and using our deep technical expertise to justify a complete and fair scope of work. We recommend starting with our expert assessment before deciding if a public adjuster is necessary for your situation.

What if the Insurance Company’s Offer Is Too Low?

It is very common for an initial insurance offer to seem inadequate. Do not accept an offer you believe will not fully restore your property. View it as the beginning of a negotiation.

Your first step is to politely request a detailed, line-by-line breakdown of their estimate. Compare it side-by-side with the comprehensive scope of work provided by your restoration contractor. We often find that adjusters have missed significant items, such as hidden smoke damage in HVAC systems, compromised electrical wiring, or soot contamination in attics.

You can then present your contractor’s detailed estimate and supporting evidence to negotiate a more appropriate settlement. If the insurer remains unwilling to offer a fair amount, your policy includes an “appraisal” clause. This is a formal dispute resolution process that brings in neutral parties to arrive at a binding final number.

Managing a fire damage claim is a monumental task, but you don’t have to face it alone. The expert team at Sparkle Restoration Services is here to provide the authoritative guidance and strong advocacy you need. As an award-winning, IICRC Master Certified firm and licensed General Contractor, we handle the entire process, from initial assessment to direct insurance negotiations, ensuring your Orange County property is restored to the highest standard.

Contact us today for a complimentary consultation and let us help you turn chaos into calm, fast.

Ready to create a space that’s as beautiful as it is functional? Schedule your complimentary design consultation today by visiting Ready to Work with Sparkle?