When you discover a burst pipe, a small kitchen fire, or a patch of mold in your Orange County home, it's easy to feel overwhelmed. While panic is a natural first reaction, the steps you take in the first 48 hours are absolutely crucial. These actions don't just protect your property; they set the stage for your entire insurance claim. At Sparkle Restoration Services, an IICRC Master Certified and award-winning firm, we believe in turning chaos into calm, fast.

Think of this as your emergency playbook—a clear, stress-reducing guide from a trusted expert to help you navigate the immediate aftermath with confidence.

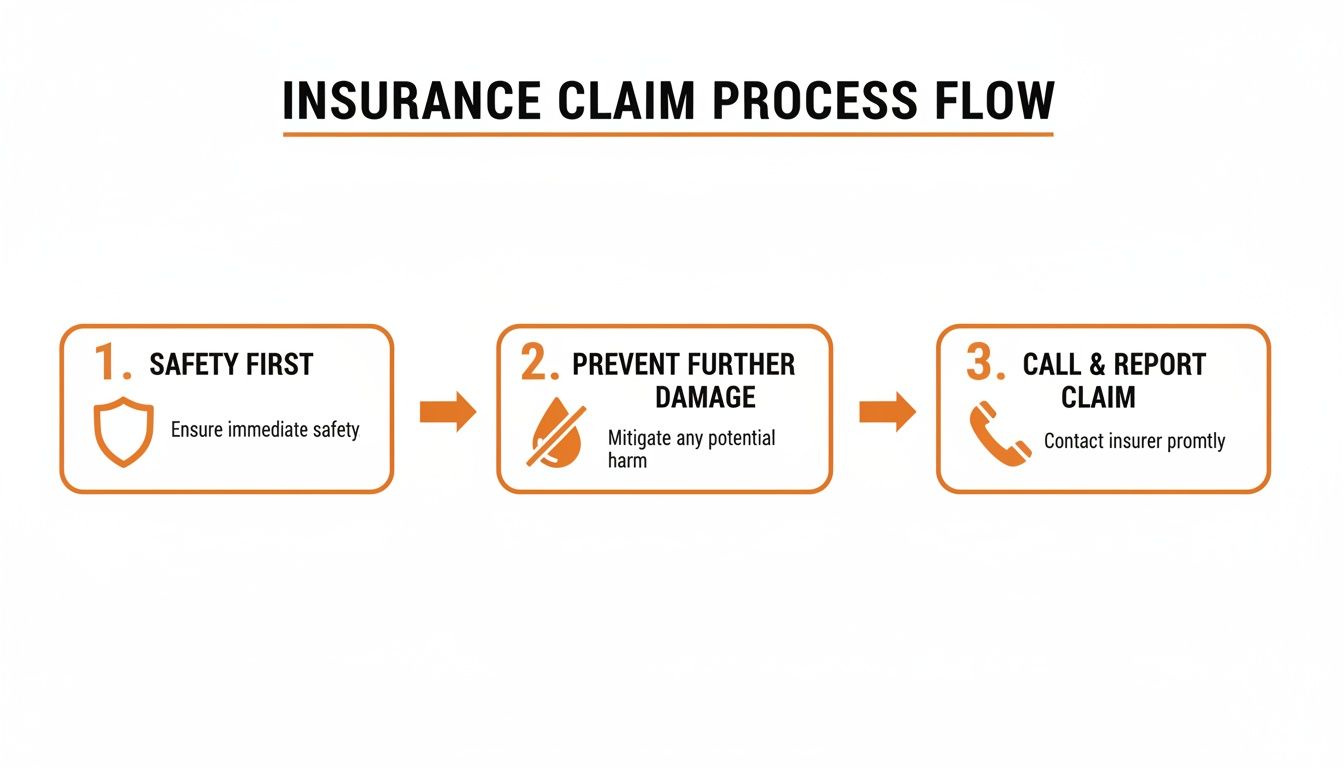

Safety First, Always

Before you even think about the damage, your number one priority is ensuring everyone is safe.

If you’ve experienced a fire, do not re-enter the building until the fire department gives the all-clear. For water damage, the most significant immediate risk is electrical shock. If you see standing water near outlets, appliances, or electronics, head straight to your breaker box and shut off the power to the affected areas.

Stop the Damage from Spreading

Once the area is secure, your next job is to prevent the problem from worsening. Your insurance policy actually requires this; it’s called your “duty to mitigate damages.”

For a leaking pipe, this means finding and shutting off the main water valve. If a storm has damaged your roof, it might mean having a professional place a tarp over it. This is a non-negotiable step for your claim. Insurers need to see that you acted responsibly to control the loss.

This is the perfect time to call a 24/7 IICRC-certified professional like Sparkle Restoration Services. As a licensed General Contractor and a BBB Torch Award Winner for Ethics, our emergency teams serve Newport Beach, Irvine, and all of Orange County. We get on-site fast to start water extraction or secure your home, not only satisfying your policy requirements but also allowing us to document the damage right from the start.

For more proactive tips, check out our guide on building a https://sparklerestoration.com/water-emergency-first-aid-kit/.

Following this sequence—Safety, Prevention, and Calling Your Insurer—creates a strong, orderly foundation for your entire claim process.

When you're in the middle of a property disaster, it's tough to remember everything. This quick checklist breaks down the most critical actions you need to take right away to protect both your property and your insurance claim.

Immediate Action Checklist After Property Damage

| Priority Action | Why It's Critical for Your Claim | Who to Call |

|---|---|---|

| Ensure Scene Safety | Establishes you acted responsibly; prevents injuries that could complicate the claim. | Fire department (for fire), electrician (for electrical hazards), or utility company. |

| Shut Off Utilities | Fulfills your "duty to mitigate" by stopping the source of damage (e.g., water, gas). | Yourself (if safe), a plumber for water main issues. |

| Call a 24/7 Mitigation Pro | Provides professional, immediate help to prevent further damage like mold or structural issues. | An IICRC-certified company like Sparkle Restoration Services. |

| Document Everything | Creates a baseline record of the damage before cleanup, which is vital evidence. | Yourself (photos/videos), your mitigation contractor. |

| Notify Your Insurer | Officially starts the claim process within the required timeframe (usually 24-48 hours). | Your insurance company's claims hotline. |

Tackling these priorities methodically turns a chaotic situation into a manageable process, putting you in a much stronger position for a successful claim.

Make the Call to Your Insurance Company

With safety handled and mitigation efforts underway, it's time to get your insurer in the loop. Promptly filing a claim can significantly improve your chances of approval and speed up the recovery. Waiting too long is a costly mistake; some industry data suggests 30-40% of claims are rejected simply due to late submission or missing information. Most policies require you to report the loss within 24 to 48 hours.

Have your policy number handy when you call, and be ready to give a clear, factual account of what happened.

Expert Tip: Stick to what you know for a fact. Don't speculate about the cause or, more importantly, admit any fault. Simply state what you see: "A supply line to my washing machine burst and flooded the laundry room and hallway." Your first report becomes the official record of the loss.

This call kicks off the formal process. You'll receive a claim number, and an adjuster will be assigned to inspect the damage. For a deeper dive into what comes next, this comprehensive guide to navigating home insurance claims is a fantastic resource. By taking these initial steps correctly and calmly, you put yourself in the driver's seat for a fair and timely settlement.

Documenting Everything for a Stronger Claim

Once everyone is safe and you’ve stopped the immediate damage, your focus must shift to building a rock-solid case for your insurance claim. This comes down to one thing: evidence. The quality of the proof you provide can be the deciding factor in your settlement.

For high-value homes, especially here in Orange County where custom finishes and luxury materials are the norm, just snapping a few quick pictures on your phone won't be enough. You need to create a detailed, undeniable record of your loss. Think of yourself as a detective building a case. Your mission is to leave no room for doubt, ensuring every damaged item is accounted for at its true value. This is what separates a frustrating, lowball offer from a fair and smooth settlement.

Create a Compelling Visual Record

Your photos and videos are the most powerful tools in your arsenal. Today's smartphones are excellent for this, but it’s how you use them that matters. You must go beyond wide shots and capture the specific details that define your home’s worth.

- Start with a Video Walkthrough: Before anything is moved or cleaned, record a slow, steady video of the entire affected area. As you record, narrate what you’re seeing in real-time. For example: "This is the custom cabinetry in the kitchen. You can see the water line is about six inches up, causing the wood to swell and separate."

- Capture Both Wide and Close-Up Views: Take broad photos of each room from several angles to establish the scene. Then, zoom in on high-value items—the warped planks of your European oak flooring, the soot stains on a Sub-Zero refrigerator, or water damage on custom millwork.

- Don't Forget What's Hidden: Open every cabinet, closet, and drawer to document damage to the contents inside. When dealing with water, it’s crucial to show just how far it traveled. You can learn more in our guide to understanding the full scope of water damage.

This level of detail proves the real cost of making things right. An adjuster who sees clear, undeniable evidence of damage to premium materials is far more likely to approve a scope of work that replaces them with items of like kind and quality.

Compile a Comprehensive Inventory

Your visual record shows the damage, but your inventory list proves the value of what was lost. We understand this can feel like an overwhelming task, but a room-by-room approach makes it manageable. Go through each space and list everything that was damaged or destroyed.

For every item, do your best to include:

- Description: Be specific. Instead of "TV," write "Samsung 65-inch Frame TV."

- Make and Model Number: If you can find it on the item or in your records.

- Age and Original Cost: Dig up old receipts, check credit card statements, or look through online order histories.

- Estimated Replacement Cost: A quick online search will usually give you a current price.

A common mistake we see is homeowners only listing the big-ticket items. Don't forget the smaller things that add up incredibly fast—linens, kitchenware, books, and clothing. A detailed inventory can easily add thousands of dollars to your final settlement.

Maintain a Meticulous Communication Log

From your first phone call to the final check, you will have dozens of interactions with your insurance company. Keeping a log of every conversation isn't just a good idea; it’s non-negotiable. This simple record protects you from misunderstandings and creates a clear, documented timeline of your claim.

Create a simple document or spreadsheet and track these key details:

- Date and Time of Communication: Note every call, email, and meeting.

- Person You Spoke With: Always get their full name and title.

- Key Points Discussed: Summarize the conversation. What promises were made? What deadlines were given?

- Follow-Up Actions: Note any tasks assigned to you or the adjuster.

This log becomes an invaluable tool if disagreements arise. It shows you’ve been diligent and holds everyone accountable. By combining powerful visuals, a detailed inventory, and a precise communication log, you build a foundation of evidence that is incredibly difficult for any insurer to dispute, paving the way for a successful claim.

Navigating the Insurance Adjuster Meeting

The on-site meeting with the insurance adjuster is a pivotal moment in your claim. This is where your careful documentation is reviewed against the insurer's official assessment. How you manage this interaction can significantly impact the final settlement, so being prepared, confident, and clear is essential.

Don't think of the adjuster's visit as a confrontation. It’s a professional review. Their job is to verify the damage you've reported and write an estimate based on your policy's terms. Your job is to ensure they see everything—the obvious, the hidden, and the in-between—so their estimate is fair and complete.

Preparing for a Successful Inspection

Thorough preparation is the secret to a smooth, productive meeting. Before the adjuster arrives, have all your documentation organized and ready. This means your photos, videos, detailed inventory of damaged items, and your communication log should all be at your fingertips.

Your goal is to present a clear, logical case. Walk them through your property and point out the specific damage you’ve recorded. A calm, factual presentation builds your credibility and helps the adjuster grasp the full scope of your loss right from the start.

A common mistake is assuming the adjuster will find all the damage on their own. They often manage dozens of claims and may be on a tight schedule. It is your responsibility to guide them and ensure nothing is overlooked.

The Advantage of Having a Professional Advocate

This is a strategic game-changer: have a trusted restoration professional by your side during the inspection. The insurance company's adjuster works for them. An IICRC Master Certified professional from Sparkle Restoration Services works for you. We become your advocate, speaking the same technical language as the adjuster to ensure no detail gets lost in translation.

Our expertise makes a huge difference in common scenarios:

- Hidden Water Damage: An adjuster might only note surface-level water stains. Our project managers use professional moisture meters to find moisture trapped behind walls or under high-end flooring—the kind of hidden problem that leads to mold if ignored.

- Soot and Smoke Contamination: After a fire, soot can infiltrate your HVAC system and spread throughout the entire house. We know exactly where to look for this hidden contamination, ensuring the full deodorization and cleaning scope is included in the claim from day one.

- Matching Materials: In luxury Orange County homes, you can't just replace a damaged cabinet with a generic one. We ensure the estimate accounts for matching custom millwork, unique finishes, and high-end materials to restore your home to its original character.

Having us there transforms the meeting from a simple inspection into a collaborative session to define the proper scope of work, which is absolutely critical for a fair outcome. Understanding these dynamics is a key part of asserting your rights. You can learn more in our dedicated guide on knowing your rights during an insurance claim.

Reviewing the Scope of Loss Report

After the visit, the adjuster will draft a formal document called a scope of loss. This report is a detailed, line-by-line breakdown of the necessary repairs and their estimated cost, forming the basis for your settlement offer.

Do not accept this document as final. Review it with a fine-tooth comb, comparing it against the estimate provided by your own restoration contractor.

Pay close attention to these areas:

- Completeness: Did they include every single damaged item from your inventory and everything you pointed out during the inspection?

- Accuracy in Materials: Does the scope account for replacing damaged materials with those of "like kind and quality," as most policies require? Or did they budget for builder-grade materials when you had custom finishes?

- Correct Measurements: Are the square footage calculations for flooring, drywall, and paint accurate? Small errors here can add up to thousands of dollars in shortfalls.

- Local Labor Rates: Do the cost estimates reflect current labor and material costs here in Orange County? National averages are not sufficient for our market.

If you find discrepancies—and it is common to find them—you have every right to challenge the scope. This is precisely where having Sparkle's detailed, competing estimate is so valuable. We can submit a supplement to the adjuster with our findings, providing clear justification for any additions or corrections. This professional, data-driven approach is the single most effective way to negotiate a settlement that truly covers the full cost of restoring your home.

Understanding Your Insurance Settlement Offer

Once the adjuster has completed their assessment, you’ll receive a settlement offer filled with industry terms that can be confusing. Understanding this financial puzzle is key to ensuring you have the funds not just to repair, but to bring your home back to its pre-loss condition—or even better. For many of our Orange County clients, this moment marks a shift from overwhelm to opportunity.

Decoding Key Settlement Terms

Two terms are central to your offer: Replacement Cost Value (RCV) and Actual Cash Value (ACV). Most policies are RCV policies, but the payment unfolds in stages, which often surprises homeowners.

Here’s a quick comparison of the key financial terms in your offer:

Claim Settlement Terms Explained

| Term | What It Means for You | Example |

|---|---|---|

| Replacement Cost Value (RCV) | Total cost to replace damaged property with brand-new materials of like kind and quality. | A roof that costs $15,000 to replace, regardless of its age. |

| Actual Cash Value (ACV) | RCV minus depreciation for age, wear, and tear. This is your first payment. | An initial payment of $10,000 on that $15,000 roof after factoring in depreciation. |

| Recoverable Depreciation | The remaining balance (RCV − ACV) released after repairs are completed and invoiced. | The final $5,000 check you receive once you’ve submitted proof of repair invoices. |

Keeping these terms straight will help you track payments and avoid surprises when your first check arrives.

Most insurers issue the first check for the ACV amount, so it often appears smaller than you expect. This payment is used to begin repairs. After the work is finished and you submit final invoices, the insurer releases the recoverable depreciation—the remaining funds to close out your claim.

“When homeowners see a smaller first check, panic can set in. It's important to remember that this is just the ACV payment, not the full settlement. Your restoration partner can guide you on managing cash flow until the final depreciation is paid.”

You might also see references to fair market value. For more on that, check out this primer on understanding fair market value.

Navigating Payments With a Mortgage Company

Having a mortgage adds another layer of process. Your settlement check will likely be made out to both you and your lender, as they have a vested financial interest in ensuring the property is properly repaired.

Here’s how it typically works:

- You endorse the check and send it to your mortgage company.

- They hold the funds in an escrow account.

- As work progresses, they release payments to your contractor in stages, often tied to inspection milestones.

While it involves more paperwork, this process is designed to protect all parties and keep the project on track.

Turning a Setback Into an Opportunity

Dealing with water, fire, or mold damage is stressful—but it’s also a rare chance to rethink and improve your space. We’ve guided countless homeowners who decided to pivot from “repair only” to “upgrade and elevate.”

Take an Irvine family whose kitchen flooded from a failed supply line. Their policy covered restoring the dated 1990s layout. Instead, they augmented the settlement with their own funds and partnered with Sparkle’s design-build services to craft a full luxury remodel.

What could have been a simple cabinet replacement became custom solid-wood cabinetry. The soggy laminate floors were swapped for wide-plank European oak. The result: a stunning, value-boosting transformation born from a disaster.

By working with a restoration partner who is also a licensed general contractor with design expertise, you turn chaos into calm—and outdated rooms into modern showpieces. The key is preparation, patience, and partnering with experts who advocate for you. When you understand your settlement, you’re in control—and ready to rebuild better than before.

Common Claim Filing Mistakes to Avoid

Navigating the insurance claims process can feel like walking through a minefield. A few seemingly innocent missteps can unfortunately reduce your settlement or, in the worst cases, lead to a denial.

As dedicated advocates for homeowners in Orange County, we’ve seen the same costly errors repeatedly. The good news? They are entirely avoidable. Let's walk through the most common slip-ups so you can sidestep them with confidence.

Discarding Damaged Items Prematurely

After a flood or fire, your first instinct is to clean up and haul out the debris. While it's tempting to get rid of ruined furniture, soggy drywall, and damaged appliances, throwing anything away before the adjuster has seen it is one of the biggest mistakes you can make.

Those damaged belongings are your physical proof—the evidence that backs up every line item on your claim. Without them, the adjuster is left to guess at the value of what you lost, which often leads to a lower estimate. Your ruined hardwood floors and high-end refrigerator are tangible proof justifying a higher settlement.

Expert Tip: Set up a specific "do not discard" zone for all damaged items. If you must move things for safety, take dozens of photos and videos of them in their original location first. Then, move them to a secure area like the garage or a tarped-off section of the yard where the adjuster can easily inspect everything.

Accepting the First Offer Without Scrutiny

Think of the insurance company's first settlement offer as a starting point, not the final word. It's based on their adjuster's initial walkthrough, which can easily miss the full scope of damage, especially in homes with custom finishes or complex issues like hidden water or smoke damage.

Accepting that first offer can leave you thousands of dollars short of what you actually need to restore your property properly.

This is where an experienced, IICRC-certified contractor like Sparkle Restoration Services becomes your most valuable asset. We build a detailed, line-item estimate using the same software insurers use. This competing estimate becomes a powerful negotiation tool, highlighting every overlooked detail and justifying the true cost to restore your home to its pre-loss condition. It ensures you get every dollar you're entitled to.

Signing Forms Under Pressure

During the claims process, you will be given various documents to sign. Be incredibly careful with any form that contains phrases like "final payment" or "full and final release of all claims."

Do not sign anything with this language until you are 100% certain all repairs are complete and there are no surprise costs looming.

Signing a final release prematurely can legally prevent you from filing a supplemental claim if hidden damage appears later—which is common with water and fire damage. For instance, mold can bloom weeks after the initial water event if the structure wasn't dried completely.

Always take a moment to read every document thoroughly. If you have any doubts, have your restoration contractor or even a legal professional review it. That simple step protects your right to seek additional funds if unexpected problems surface, ensuring your claim truly covers the complete cost of your recovery.

Frequently Asked Questions About Insurance Claims

Trying to understand an insurance claim can feel like learning a new language, especially when you're already dealing with the stress of damage to your Southern California home. As a trusted restoration partner for homeowners across Orange County, we hear the same questions time and again. Here are straightforward, authoritative answers to what our clients worry about most.

How Long Do I Have to File an Insurance Claim in California?

This is a critical and often misunderstood point. While California law provides a specific window to file a lawsuit if you and your insurer cannot agree on a claim, your policy has much tighter deadlines for simply reporting the loss.

Most policies require "prompt notice," which is almost always interpreted as within 24 to 72 hours of discovering the damage. Waiting longer could give the insurer a reason to deny your claim. Our advice is firm: report the damage the same day you find it. At Sparkle Restoration Services, we often guide our clients through that initial call, ensuring they provide the right facts from the start without speculating or accidentally admitting fault.

Do I Need to Hire My Own Public Adjuster?

For most residential claims—such as those involving a burst pipe, a small kitchen fire, or a mold discovery—a top-tier restoration contractor is your best advocate. A firm like Sparkle Restoration Services deals with insurance adjusters daily. We speak their language, use the same estimating software, and know precisely how to document a loss to justify a fair settlement.

A public adjuster, who takes a percentage of your final settlement, is typically only necessary for massive, complex, or intensely disputed claims. We always recommend starting with a trusted, IICRC Master Certified contractor first. You should only consider hiring a public adjuster if the claim process hits a major roadblock or becomes truly adversarial.

What If My Insurer's Settlement Offer Is Too Low?

Receiving a low offer is incredibly common and disheartening. It’s important to see that initial offer for what it is: a starting point based on the adjuster's first quick look. You should never accept an offer that doesn't fully cover the cost of restoring your home to its pre-loss condition.

This is exactly where a detailed, line-item estimate from a professional restoration firm becomes your most powerful negotiating tool.

We use the same industry-standard software as major insurance carriers. The difference is, our estimates are built from the ground up to reflect the realities of luxury Orange County homes—accounting for things like matching custom millwork or sourcing high-end fixtures that are often overlooked. This allows us to submit a well-supported supplement to argue for a fair settlement that truly restores your home.

Can I Start Repairs Before the Claim Is Approved?

You absolutely can—and in fact, you must—start emergency mitigation services immediately. Your policy requires you to take reasonable steps to prevent the damage from worsening. This includes immediate actions like:

- Water extraction and setting up structural drying equipment.

- Boarding up broken windows or tarping a leaky roof.

- Securing the property from theft or further damage.

What you cannot do is begin permanent reconstruction or cosmetic repairs until you and your insurer have an agreed-upon scope of work and cost. Tearing out a damaged kitchen before the adjuster has inspected it can jeopardize your claim, as there's no way for them to verify the original loss. Sparkle Restoration Services expertly manages the emergency mitigation phase while meticulously documenting everything needed for the full restoration, keeping your project in sync with your claim's approval.

For more answers, explore our complete list of frequently asked questions on insurance and restoration.

Ready to create a space that’s as beautiful as it is functional? Schedule your complimentary design consultation today by visiting Ready to Work with Sparkle?