Dealing with water damage in your Orange County home is stressful enough; figuring out your insurance shouldn't add to the chaos. As restoration experts, we've helped countless clients navigate this process. The most critical thing to understand is that your standard homeowner's policy is designed for disasters that are sudden and accidental. Think of a pipe bursting or a washing machine suddenly overflowing.

What it's not designed for are slow, creeping issues like a gradual leak behind a wall or widespread flooding from a storm. Those situations almost always require a different type of policy or endorsement. Understanding this distinction is the first step to a successful claim.

What Your Standard Homeowners Policy Actually Covers

When your Orange County property is hit with water damage, the first question is always, "Am I covered?" The answer comes down to one fundamental principle that guides nearly every homeowners insurance policy.

Think of your coverage as a safety net designed to catch you when unexpected disasters strike. It is not intended to handle problems that arise over time due to neglect or major natural floods.

This is a critical distinction. Your policy is there to protect you from sudden water damage originating inside your home. It’s for the pipe under the kitchen sink that abruptly bursts and ruins your custom cabinets, or the washing machine hose that splits and soaks the laundry room. These are precisely the scenarios for which insurance is designed.

The "Sudden and Accidental" Rule

Insurance carriers operate by the "sudden and accidental" rule. It’s the primary filter they use to determine a claim's validity. To give you a clearer picture, here are some events that typically receive a green light for coverage:

- Appliance Malfunctions: A dishwasher, washing machine, or water heater that fails and leaks without warning.

- Plumbing Failures: A pipe that freezes and bursts during a cold snap or a supply line to a toilet that suddenly breaks.

- Accidental Overflows: A bathtub or sink is accidentally left running, spilling water and damaging the floors below.

- HVAC Leaks: A sudden leak from your air conditioning unit’s drain line.

Understanding this concept is the first step to mastering your policy. To truly get a handle on your water damage insurance coverage, you also need to understand key terms like what is a deductible in insurance, which directly affects what you'll pay out-of-pocket.

To make this even simpler, here's a quick reference guide.

Quick Guide to Water Damage Coverage

This table offers a snapshot of what's typically covered versus what's usually excluded in a standard homeowner's policy. Use it as a starting point to understand where your situation might fall.

| Scenario | Typically Covered? | Key Consideration |

|---|---|---|

| Burst pipe under the sink | Yes | The event was sudden and unexpected. |

| Slow, dripping faucet causing rot | No | This is considered a maintenance issue, not accidental. |

| Washing machine hose splits | Yes | A clear example of a sudden appliance failure. |

| Groundwater seeping into basement | No | Seepage is gradual and considered a flooding event. |

| Toilet overflows and floods bathroom | Yes | An accidental, internal water event. |

| River overflows and floods home | No | This requires a separate flood insurance policy. |

Remember, this is a general guide. The specific language in your policy is what ultimately matters, so it's always best to review the fine print with your agent.

Why the Source of Water Matters

On the flip side, damage from gradual leaks—like that slow drip behind a wall you don’t notice for months—is almost always excluded from coverage. Why? Because insurers view it as a maintenance issue you were responsible for, not a true accident.

The same logic applies to water originating from outside. Widespread flooding from a storm surge hitting Newport Beach or a nearby river overflowing its banks will not be covered by your standard policy. That is what separate flood insurance is for.

At Sparkle Restoration, we are more than just an IICRC Master Certified firm and a BBB Torch Award Winner for Ethics; we are your advocate. Our role is to provide the expert documentation you need to clearly demonstrate to your insurer that the damage was, in fact, sudden and accidental. This strengthens your claim from the very beginning.

And these aren't rare occurrences. Statistics show that water damage and freezing account for a staggering 43.21% of all home insurance claims. This really drives home how common these events are and why this coverage is so vital.

A clear understanding of your policy, paired with a restoration partner you can trust, makes all the difference. If you want to dig deeper, explore our guide on the basics of water damage.

Why Flood Damage Requires a Separate Policy

One of the most expensive and heartbreaking lessons in homeownership is discovering the sharp line insurance companies draw between "water damage" and "flood damage." Many homeowners are blindsided, assuming their standard policy is a catch-all for any water disaster. It’s not.

The reality is, where the water originates is the single most important factor. Misunderstanding this could lead to a denied claim and a massive financial nightmare.

Think of it this way: if the water's source is inside your house—a burst pipe, a washing machine hose that gives out, an overflowing toilet—it's generally considered water damage. Your standard homeowner's policy will likely step in to help. But the moment water from the outside world crosses your threshold, you’re in a completely different category. That’s a flood.

Defining a Flood in Insurance Terms

In the insurance world, "flood" isn't just about biblical deluges or coastal storm surges. The official definition is very specific and often catches people by surprise.

The National Flood Insurance Program (NFIP) defines a flood as a temporary condition where two or more acres of normally dry land (or two or more properties) are inundated by water or mudflow. This isn't limited to a river breaking its banks. It can be caused by:

- Overflow of inland or tidal waters: Think of rivers cresting or storm surges hitting coastal communities like Newport Beach.

- Unusual and rapid accumulation of surface waters: This is your classic flash flood, where heavy, sudden rainfall overwhelms local drainage systems.

- Mudflow: A common threat in Southern California's hillside communities, especially after intense rains saturate the soil.

Because these events are so destructive and widespread, your standard homeowner's (HO-3) policy unequivocally excludes flood damage. The financial risk is simply too large for a private insurer to carry on a standard plan, which is why a dedicated flood policy isn't just a good idea—it's essential protection for your assets.

Why Standard Policies Exclude Flooding

Imagine a massive storm pounds Orange County, flooding thousands of homes. If a single insurance company had to pay every one of those claims under its standard policies, the financial impact would be catastrophic. It could easily bankrupt the insurer.

To maintain industry stability, this specific, high-level risk is separated from everyday household mishaps. This is precisely why the federal government created the National Flood Insurance Program (NFIP). The NFIP pools that massive risk on a national scale, making flood insurance accessible and affordable for homeowners, renters, and businesses. You can also purchase private flood insurance, which often offers higher coverage limits.

Expert Insight: "Many people in Southern California assume they're safe if they don't live directly on the coast. But FEMA data is clear: more than 20% of flood claims come from properties located outside of high-risk flood zones. A separate policy isn't a luxury; it's a critical layer of financial security for your home and family."

Securing the Right Protection for Your Property

For anyone owning property in Orange County, this isn't just theoretical. The region is prone to powerful storm systems that can trigger flash flooding, as we've seen with the recent El Niño-driven rain storms in Orange County. Knowing your risk is the first step toward being prepared.

Without a separate flood policy, you are responsible for 100% of the repair costs after a flood. That includes everything from structural work and replacing all your belongings to the inevitable mold remediation that follows.

As IICRC Master Certified experts, our team at Sparkle Restoration has seen the devastating aftermath of both internal water damage and external flooding. We have witnessed firsthand the financial and emotional destruction an uncovered flood takes on a family. No matter where the water came from, we’re equipped to handle the restoration, but having the right insurance in place is the first step toward a calm and efficient recovery.

Sudden Water Damage Your Policy Typically Covers

Now that we've established the all-important "sudden and accidental" rule, let's explore what that looks like in the real world. This is where your standard homeowners policy acts as your financial shield, and for most Orange County homeowners, this part of your water damage insurance coverage is your first line of defense against unexpected chaos.

The core idea is simple: the event had to be unforeseeable and happen quickly, not over a long period. Insurers cover these incidents because they're true accidents, not problems that could have been avoided with diligent upkeep.

Common Covered Appliance Failures

Our homes are filled with modern conveniences, but every water-using appliance is also a potential water hazard. When one of them fails without warning, the resulting damage is a textbook example of a covered event.

Let's say you walk into your Irvine kitchen after a day out to find water pooling across your new custom floors. You trace it back to a ruptured supply line on your dishwasher. This wasn't a slow drip—it was a catastrophic failure that flooded your kitchen in a matter of hours. That's a covered claim.

Here are a few other common scenarios we see:

- Washing Machine Hose Burst: The supply hose on your washer suddenly splits, gushing gallons of water into your laundry room and soaking the hallway carpets.

- Water Heater Rupture: The tank of your water heater in the garage abruptly fails, flooding the space and ruining stored belongings and drywall.

- Refrigerator Ice Maker Line Leak: A tiny plastic line feeding your ice maker cracks, leaking water behind the fridge and damaging the wall and subfloor before you even notice.

In every case, the suddenness of the failure makes all the difference. Your policy is there to cover the cost of the aftermath—from professionally drying the structure to replacing ruined flooring and drywall.

Plumbing System Catastrophes

Beyond your appliances, the plumbing system itself is a frequent source of sudden water damage claims. These events are often dramatic and cause extensive damage in a very short time, making them clear-cut cases for your insurance company.

Picture this: an upstairs toilet supply line bursts in your Newport Beach home. It's not just the bathroom that's flooded. Water is seeping through the floor, saturating the living room ceiling below until it's stained, sagging, and eventually collapses.

An immediate response is critical in these situations. The first step after ensuring safety and stopping the water source is to call a certified restoration expert. As an IICRC Master Certified firm, Sparkle Restoration’s 24/7 emergency team can immediately begin water extraction and mitigation. This rapid action not only prevents secondary damage like mold growth but also provides crucial documentation that strengthens your insurance claim.

Other classic plumbing mishaps that are typically covered include:

- Frozen Pipe Burst: During a rare Southern California cold snap, a pipe in an uninsulated wall freezes solid. When it thaws, it bursts, leading to a massive leak.

- Accidental Overflow: A bathtub faucet is left running, and the overflow drain can’t keep up. Water spills over the edge, damaging multiple floors of your home.

The principle is always the same: the damage was from a distinct, accidental event, not a slow, neglected leak. Knowing these scenarios helps you recognize when your policy is there to help you recover, turning a chaotic situation back to normal with the right professionals on your side.

Common Exclusions Your Insurance Will Not Cover

Knowing what your water damage insurance coveragedoesn't cover is just as important as knowing what it does. For many homeowners, the most distressing moments come when they discover—after the damage is done—that their specific problem isn't covered. Policies are built to handle sudden, accidental events, not problems that have been brewing for a while or that stem from a lack of upkeep.

This is a critical distinction, and understanding it can save you thousands in out-of-pocket costs. Once you’re familiar with these common exclusions, you can take proactive steps to protect your Orange County property and avoid a denied claim.

Gradual Damage is Never Covered

The single biggest reason for a denied water damage claim is gradual damage. This isn't an accident; it's any issue that develops slowly over weeks, months, or even years. From an insurer's perspective, this falls under the umbrella of homeowner maintenance, not an insurable event.

Think about a slow, tiny drip from a pipe hidden inside your bathroom wall. For months, it goes completely unnoticed, quietly soaking the drywall, encouraging mold growth, and causing the wood studs to rot. By the time you spot the damage, it’s extensive. Your insurer will almost certainly deny the claim because the source was a long-term leak, not a sudden pipe burst.

Common examples of gradual damage that insurers won't cover include:

- Slow Leaks: That faucet that won't stop dripping, a leaky P-trap under the kitchen sink, or a failing seal around your shower pan.

- Seepage: Water that slowly works its way through your foundation or basement walls over time.

- Wear and Tear: Damage from old, corroded pipes or brittle appliance hoses that were well past their service life and should have been replaced.

Negligence and Poor Maintenance

Here is the hard truth: your insurance policy is not a home warranty or a maintenance plan. It's written with the expectation that you are taking reasonable care of your property. If water damage occurs because of clear neglect, the claim will almost certainly be denied.

For instance, if you’ve known for months that your roof is missing shingles but never got around to fixing it, you will likely be responsible for any water damage that occurs during the next rainstorm. The insurance company will argue that the damage was preventable and a direct result of your failure to maintain the property. Being proactive is key, and our guide on how to make your home leak-proof can help you spot these potential problems early on.

Client-Focused Tip: As a licensed General Contractor, Sparkle Restoration recommends a comprehensive home inspection every two years. This is the best way to identify aging pipes, failing appliance connections, or minor roof damage before they turn into a major, uncovered disaster.

Sewer Backups and Sump Pump Failures

This exclusion blindsides many homeowners. Your standard policy will not cover damage from water that backs up through sewers or drains. It also won't cover damage from a sump pump that fails.

Imagine the city sewer line on your street gets overwhelmed in a heavy downpour. If that raw sewage and water forces its way back into your home through your toilets and drains, the costly cleanup and repairs won't be covered by your base policy. The same is true if your sump pump breaks or loses power during a storm, letting your basement flood.

Thankfully, you're not powerless against these risks. Most insurers offer optional add-ons, called endorsements, that provide this specific, crucial coverage.

Optional Endorsements for Better Protection

To fill the gaps in your standard policy, you can usually purchase specific endorsements for a small additional premium. These are designed to cover the most common exclusions and give you much more comprehensive protection for your home.

Here’s a quick look at some of the most valuable add-ons available.

Common Policy Endorsements for Enhanced Coverage

| Endorsement Type | What It Covers | Who Should Consider It |

|---|---|---|

| Water Backup and Sump Pump Overflow | Damage from water backing up through sewers or drains, or from a sump pump that fails. | Any homeowner with a basement or a property located in an area with older sewer systems. |

| Hidden Water Damage Coverage | The cost to tear out and replace walls and ceilings to access and repair a slow, hidden leak. | Owners of older homes, especially if the plumbing system's condition is a mystery. |

| Service Line Coverage | The cost to repair or replace underground utility lines on your property, like water or sewer pipes. | Homeowners with mature trees (roots can cause damage) or older service lines. |

These endorsements are relatively inexpensive, but they can save you from a five-figure repair bill down the road. It’s always worth a conversation with your insurance agent to review your options.

How to Navigate the Water Damage Insurance Claim

When you discover water damage in your home, the clock starts ticking. Knowing what to do—and in what order—can feel overwhelming, but a clear head and a methodical plan will make all the difference. This step-by-step guide is designed for Southern California homeowners who need to act fast.

The entire claims process begins the moment you spot that puddle, drip, or stain. Your first moves can significantly influence your claim's outcome and how much damage your property ultimately sustains.

Your First Steps After Discovering Water Damage

As soon as you find water damage, immediate action is crucial for protecting your home and setting up a successful insurance claim. While resources like these expert tips for handling a leaking roof offer great specific advice, following a structured sequence is your best bet.

Here’s exactly what to do to protect your property and your financial interests:

Safety First, Always: Before you do anything else, assess for immediate dangers. If water is near electrical outlets, appliances, or your breaker box, shut off the power to that area immediately. Be cautious on slick floors and watch for sagging ceilings—they are a sign of serious structural risk.

Stop the Source: If it's safe to do so, shut off the water. This could be as simple as turning the valve behind a toilet or as comprehensive as shutting off the main water supply to your house. The faster you stop the flow, the less damage you’ll have to mitigate.

Document Everything: This is non-negotiable. Before you move or clean anything, use your smartphone. Take numerous photos and videos of the damage, the affected rooms, and your soaked belongings. If you can see the source of the water, get clear shots of that as well. This visual evidence is invaluable for your insurance claim.

Notifying Your Insurer and a Restoration Professional

Once you've handled the immediate crisis, you have two critical phone calls to make: one to your insurance company and one to a certified restoration company. The timing and order here really matter.

Contact your insurance agent or carrier right away to initiate the claims process. They will give you a claim number and tell you when to expect an adjuster. Have your policy number handy and be prepared to explain what happened clearly.

Expert Insight: "Your policy includes a 'duty to mitigate' clause, which means you're required to take reasonable steps to prevent further damage. Calling a 24/7 emergency restoration firm like Sparkle immediately fulfills this duty and demonstrates to your insurer that you acted responsibly to protect your property."

At Sparkle Restoration, we are not just a cleanup crew. We are an IICRC Master Certified firm and a licensed General Contractor, which means we become your advocate from start to finish. We respond rapidly to begin emergency water mitigation, using industrial-grade equipment to extract water and professionally dry your home.

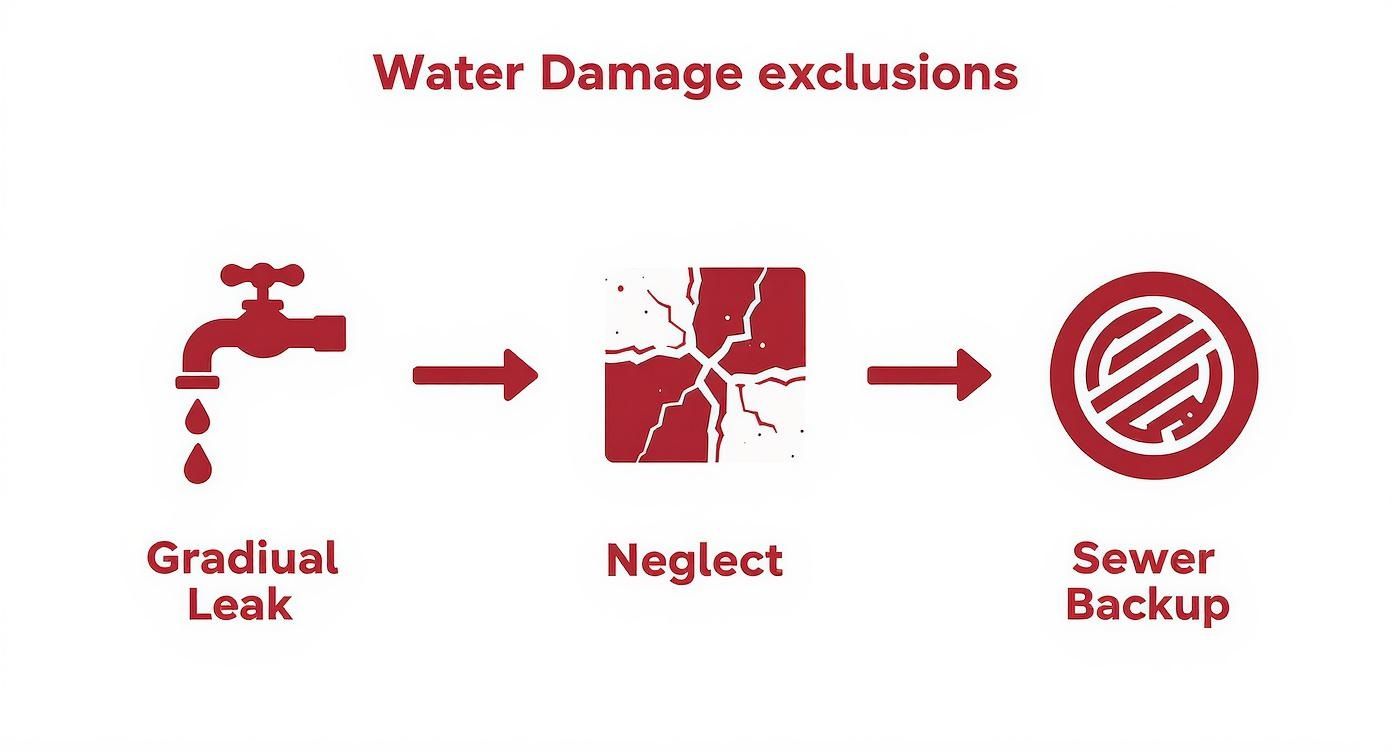

This infographic shows some of the most common reasons claims get denied, which is why taking these first steps correctly is so important.

As you can see, things like slow leaks, neglect, and sewer backups are common pitfalls that lead to a denied claim unless you have the right endorsements on your policy.

Sparkle Restoration’s Role in Your Claim

We work directly alongside your insurance adjuster. We provide the detailed moisture readings, professional assessments, and meticulous documentation they need to process a successful claim. We speak their language, ensuring every bit of covered damage is reported and accounted for. This partnership turns a chaotic mess into a calm, controlled process—fast. The system can be complex, which is why we created our homeowners guide to navigating the property insurance claims process.

The financial toll of water-related events is massive. Globally, insured losses from floods and major storms climb into the billions. In the U.S., severe storms packing torrential rain are a huge part of those losses. By following a clear, proven process, you protect yourself from becoming just another statistic.

Partnering with Sparkle for a Seamless Recovery

Trying to manage a water damage insurance claim on your own can feel like taking on a second full-time job. Suddenly, you're buried in paperwork, deciphering complex policy language, and coordinating with adjusters—all while your home is in disarray. This is where having a true partner in your corner transforms a chaotic mess into a calm, controlled recovery.

At Sparkle Restoration Services, we are more than just a cleanup company. We serve as your single point of contact and expertise, from the moment you call our emergency line to the final walkthrough of your restored and remodeled home. We hold dual credentials as an IICRC Master Certified firm and a licensed General Contractor, a rare combination that allows us to manage your entire project under one roof.

Your Advocate from Mitigation to Remodel

When our 24/7 emergency team arrives, our first and most critical task is mitigation. We work immediately to stop the damage from spreading, using advanced equipment to extract water and professionally dry the structure. This isn't just about cleanup; it's a crucial step that satisfies your policy's requirement to prevent secondary damage like mold.

But that's just the beginning. We also take on the heavy lifting of the claims process:

- Direct Insurance Communication: We speak the same language as insurance adjusters. We provide them with the detailed documentation, moisture readings, and professional estimates they need to process your claim smoothly and fairly.

- Expert Damage Assessment: Our certified technicians meticulously document every aspect of the loss. We ensure nothing is overlooked, so your claim reflects the true scope of the damage.

- Seamless Transition to Repairs: Once your claim is approved, we don't hand you a list of other contractors. As a General Contractor, our team seamlessly transitions from restoration right into reconstruction.

The Sparkle Design-Build Advantage

This integrated approach is what truly gives our clients peace of mind. Instead of you juggling a mitigation company, a mold specialist, and a separate builder, you have one dedicated team managing it all. A water disaster can often become an unexpected opportunity to upgrade your space.

As a BBB Torch Award Winner for Ethics, our promise is to restore your home with integrity and unparalleled craftsmanship. We turn the disruption of water damage into a chance to create the kitchen, bathroom, or living area you’ve always envisioned, often improving your property’s value in the process.

Our design-build model streamlines the entire journey, ensuring a cohesive vision from start to finish. We've proven this commitment to excellence on projects across Orange County, like a complex water damage mitigation and restoration in Irvine, CA. This unified process is how we deliver on our promise to turn chaos into calm—fast.

If you're facing a water emergency, you don't have to go it alone. Contact Sparkle Restoration Services 24/7 for immediate assistance. Let our team of certified experts handle the complexities, so you can focus on what matters most.

Your Top Water Damage Insurance Questions Answered

When you're dealing with a water-related disaster in your Orange County home, insurance questions can arise quickly. To provide immediate clarity, we've compiled answers to the most common questions we hear from homeowners in your situation.

Will My Insurance Cover Mold Damage After a Water Leak?

This is a critical question, and the answer is: it depends. Most standard homeowner's policies have some coverage for mold, but it's often limited—typically capped between $5,000 and $10,000.

The crucial detail is that coverage usually only applies if the mold is a direct result of a covered water loss—something sudden and accidental. If mold grew slowly over time from a gradual leak or a maintenance issue you failed to address, it's almost always excluded.

As IICRC-certified mold remediation experts, our team at Sparkle can properly assess the situation and provide your insurer with the exact documentation needed to connect the mold to the covered event, giving your claim its best chance for approval.

What Is Loss of Use Coverage and How Does It Work?

Loss of Use, also called Additional Living Expenses (ALE), is a critical lifeline. If a covered water damage event makes your home uninhabitable while repairs are underway, this part of your policy helps cover the extra costs.

This includes expenses like a hotel stay, restaurant meals, laundry services, and other necessities that go above and beyond your normal monthly budget. When we manage your restoration, we document the full extent of the damage, which helps you justify the need for ALE to your insurance company. This ensures your family remains safe and comfortable while we bring your home back to normal.

Expert Takeaway: In any insurance claim, thorough documentation is your greatest asset. A professional assessment from a certified firm like Sparkle provides credible, third-party evidence. It substantiates the "sudden and accidental" nature of the event for your insurance adjuster, which is crucial for getting your claim approved.

How Can I Prove Water Damage Was Not a Pre-Existing Issue?

Proving that the damage is new is key to a successful claim. The best defense is a proactive offense: keep detailed home maintenance records and take periodic photos of your property before anything goes wrong. These can be incredibly helpful.

When our certified technicians arrive, one of the first things we do is a detailed moisture inspection using professional-grade tools. This allows us to document the source, map the extent of the water, and establish a timeline. This expert report serves as powerful evidence for your adjuster, confirming the recent and accidental nature of the event.

Do I Need Flood Insurance in Orange County?

Absolutely. While not every neighborhood in Orange County is in a designated high-risk flood zone, we are all aware of how intense Southern California rainstorms can be. Standard homeowners insurance does not cover flood damage—period.

We strongly urge every homeowner, especially those in coastal or low-lying areas like Newport Beach or parts of Irvine, to secure a separate flood insurance policy. It is the only way to protect your property from the devastating financial impact a flood can deliver.

When you're facing water damage, you don’t just need a restoration company; you need a partner who can provide clear answers and expert solutions. At Sparkle Restoration Services, we use our IICRC-certified expertise to turn chaos into calm. For a seamless recovery and 24/7 emergency support, contact Sparkle Restoration Services today.

Ready to create a space that’s as beautiful as it is functional? Schedule your complimentary design consultation today by visiting Ready to Work with Sparkle?